2022 Market Update

Development Updates from Municipalities

January 2023 - 2022 was an incredibly busy year for commercial real estate sales even with the rising interest rates. Click on the links below to learn more about specific properties in the area. The 2022 report is available after the narrative.

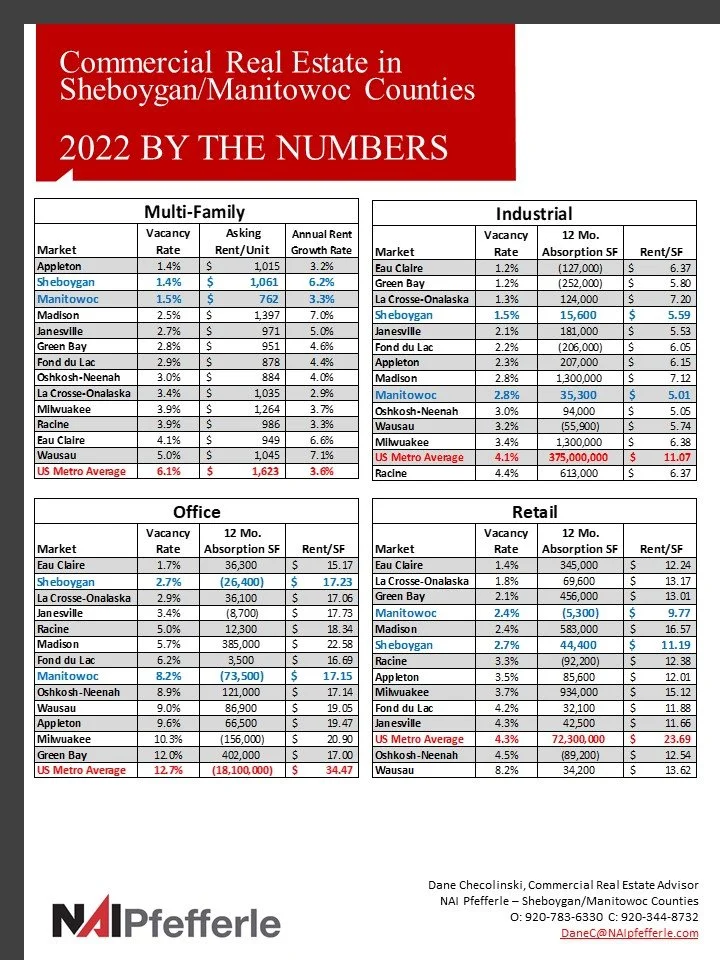

Industrial - Demand for industrial, warehouse and flex spaces has been incredibly strong to the point where vacancy in Wisconsin is almost non-existent. The “standard industrial” price point for years was $40/SF for any facility over 20,000 SF. With rising replacement costs (i.e. construction costs) the last two sales for industrial properties in Sheboygan County were well over $50/SF as new construction pricing is around $80/SF. Current market options are hovering around $70/SF just under new construction pricing. The conversation now starts at a minimum of $4.50/SF NNN for rents for 18’+ clear heights for basic warehouse space. This market has become incredibly tight. Industrial sales, albeit rare, are pushing down into the 7.5% - 8.0% for CAP rates. The first speculative industrial building in Sheboygan will be completed in June 2023.

Office - Demand for office spaces under 3,000 SF picked up a bit in 2022 while larger office spaces continue to linger on the market. Properties that have outdated décor and not up to modern building code sit on the market without much interest. A primary factor is the world has learned to “work from home” and offices are now meant to attract staff or meet with clients. They are no longer considered necessities and are now true “show pieces”. Thus the need for more modern décors and set-ups. The rental prices for office in Manitowoc and Sheboygan Counties is much lower than any other metro; however, vacancy is low. The largest piece of office on the market is ~64,000 SF listed located in the Town of Sheboygan, which is partially occupied. Lots of affordable offices are now on the market for lease or sale in the area.

Retail - High traffic retail spaces continue to perform OIK. Downtown properties in good repair are occupied and a neighborhood commercial center space is likely to go between $10-$12/SF NNN, just slightly more than Downtown spaces. New retailers have entered the area and retail rebounded a bit in 2023 as more people are going out shopping in a post-COVID world. North Town in the Town of Sheboygan is a new 99-acre development which looks to build a new living/shopping experience for the area. Sale or leases of larger restaurant spaces are slow as Buyers worry about labor.

Multifamily - CAP rates for existing multifamily are aggressive and hovering around 6.25% to 6.5% with slight pressure to move upward due to interest rates. Manitowoc completed its first downtown apartment project, drastically changing rent comparable in the market. Vacancy rates suggest the area will need more units if they wish to keep up with the labor market. Smaller properties are being absorbed for conversion to a Vacation Rental by Owner, VRBO, as total income for conversion is typically x2 – x3 more than operating a property as a typical multifamily.

If you would like the most recent market information or detailed reports for a specific asset class, please contact the office. Information includes, but not limited to:

Vacancy rates and available properties

Market rents and CAP rates

Upcoming developments

Recent sales and comparable

Municipal planning and priorities